The Vehicle Title Application (Form VTR-130) is a document used in Texas to apply for a new title for a vehicle. Similar to the Texas Odometer Statement, it requires accurate information about the vehicle, including its identification number and previous ownership details. Both forms emphasize the importance of providing truthful information to avoid legal repercussions. The VTR-130 also includes sections that require the seller's and buyer's signatures, reinforcing the accountability of both parties in the transaction.

The process of vehicle ownership transfer is multifaceted, involving various legal documents that ensure clarity and protect all parties in a transaction. One such essential document is the Texas Odometer Statement, which not only verifies mileage but also aligns with several other forms used in similar contexts. For those looking to navigate the complexities of such processes in Illinois, resources like Illinois Forms provide invaluable guidance.

The Bill of Sale is another important document in vehicle transactions. It serves as a legal record of the sale and includes details such as the vehicle's make, model, and identification number. Like the Texas Odometer Statement, the Bill of Sale requires the seller to certify the accuracy of the information provided. This document protects both the buyer and seller by establishing proof of ownership transfer and ensuring that both parties acknowledge the condition and mileage of the vehicle at the time of sale.

The Application for a Duplicate Title (Form VTR-34) is used when a vehicle owner needs a replacement title due to loss or theft. This form, like the Texas Odometer Statement, requires the vehicle's identification number and relevant details to verify ownership. Both documents underscore the importance of accurate information, as discrepancies can lead to delays or legal issues. The VTR-34 also necessitates the owner's signature, ensuring that the request for a duplicate title is legitimate and authorized.

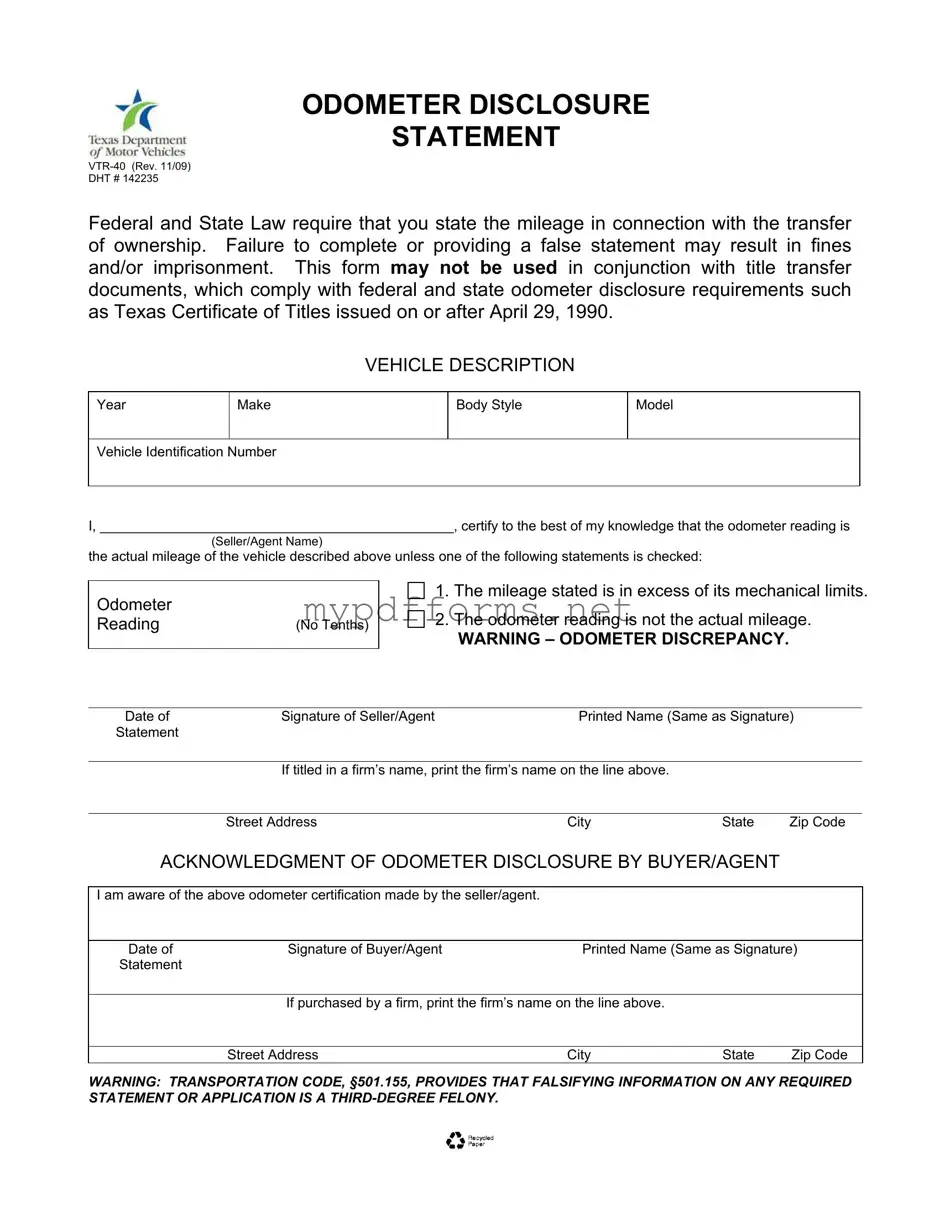

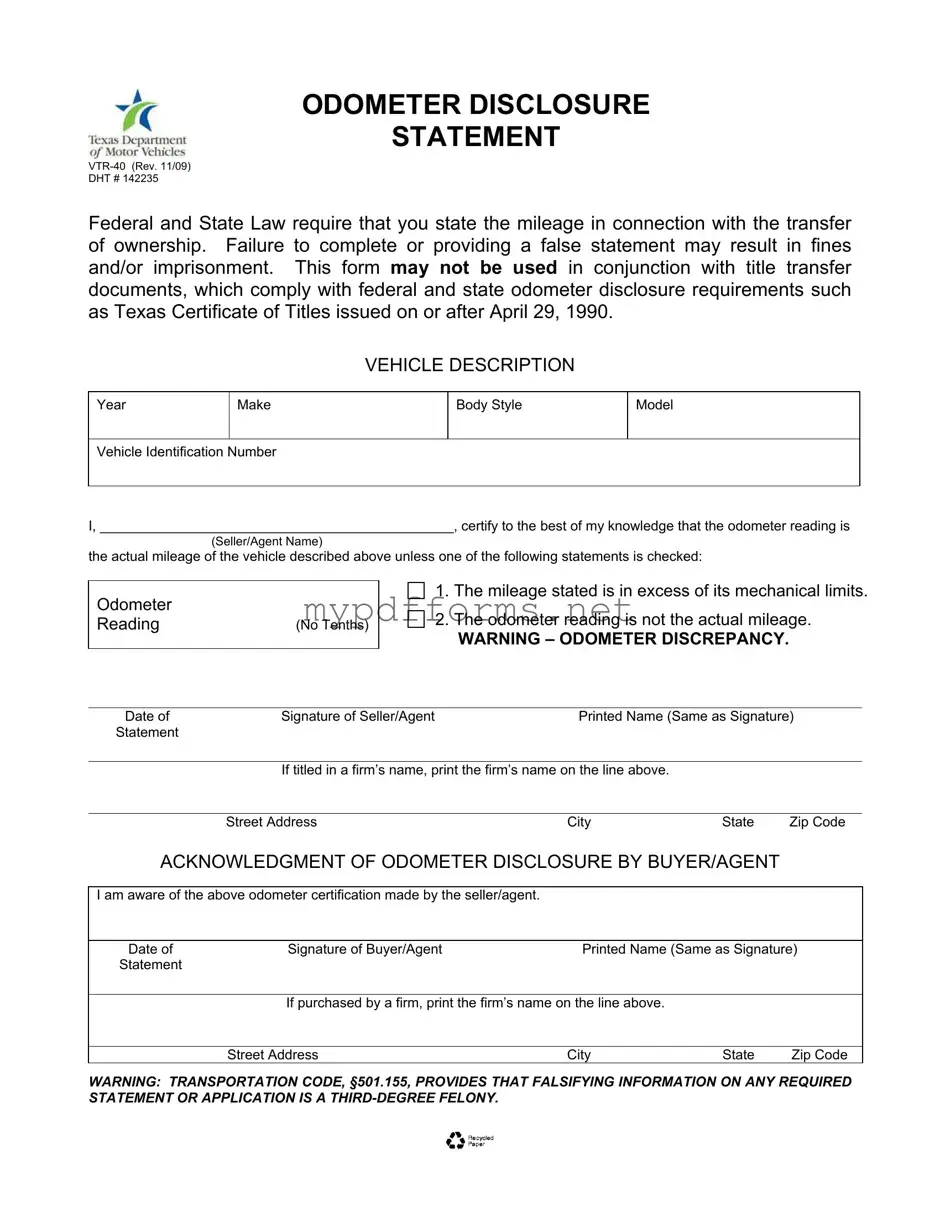

The Odometer Disclosure Statement (Form VTR-40) is a federal document that serves a similar purpose to the Texas Odometer Statement. It is required when transferring ownership of a vehicle and mandates the disclosure of the vehicle's mileage. Both forms aim to prevent odometer fraud by requiring sellers to certify the accuracy of the mileage. The federal form includes similar warnings about the consequences of falsifying information, thereby reinforcing the legal obligations of the seller in the transaction.

The Texas Application for Title (Form VTR-130) is another document that parallels the Texas Odometer Statement. This form is used when a vehicle is being registered for the first time or when ownership changes. It requires comprehensive information about the vehicle and its history, including the odometer reading. Both documents require signatures from the seller and buyer, highlighting the mutual agreement on the vehicle's condition and mileage, which is crucial for legal ownership transfer.

The Vehicle Registration Application (Form VTR-101) is used for registering a vehicle with the state. Similar to the Texas Odometer Statement, it requires details about the vehicle and the owner. Both documents emphasize the importance of accurate information to ensure compliance with state laws. The VTR-101 also includes sections for the applicant's signature, which serves as an acknowledgment of the information provided and its accuracy.

The Affidavit of Motor Vehicle Gift Transfer (Form VTR-202) is used when a vehicle is given as a gift rather than sold. This document, like the Texas Odometer Statement, requires the donor to disclose the vehicle's mileage at the time of transfer. Both forms aim to protect the interests of the recipient by ensuring that they are informed about the vehicle's condition. The affidavit also requires signatures from both parties, establishing a clear record of the transaction and the acknowledgment of the vehicle's mileage.