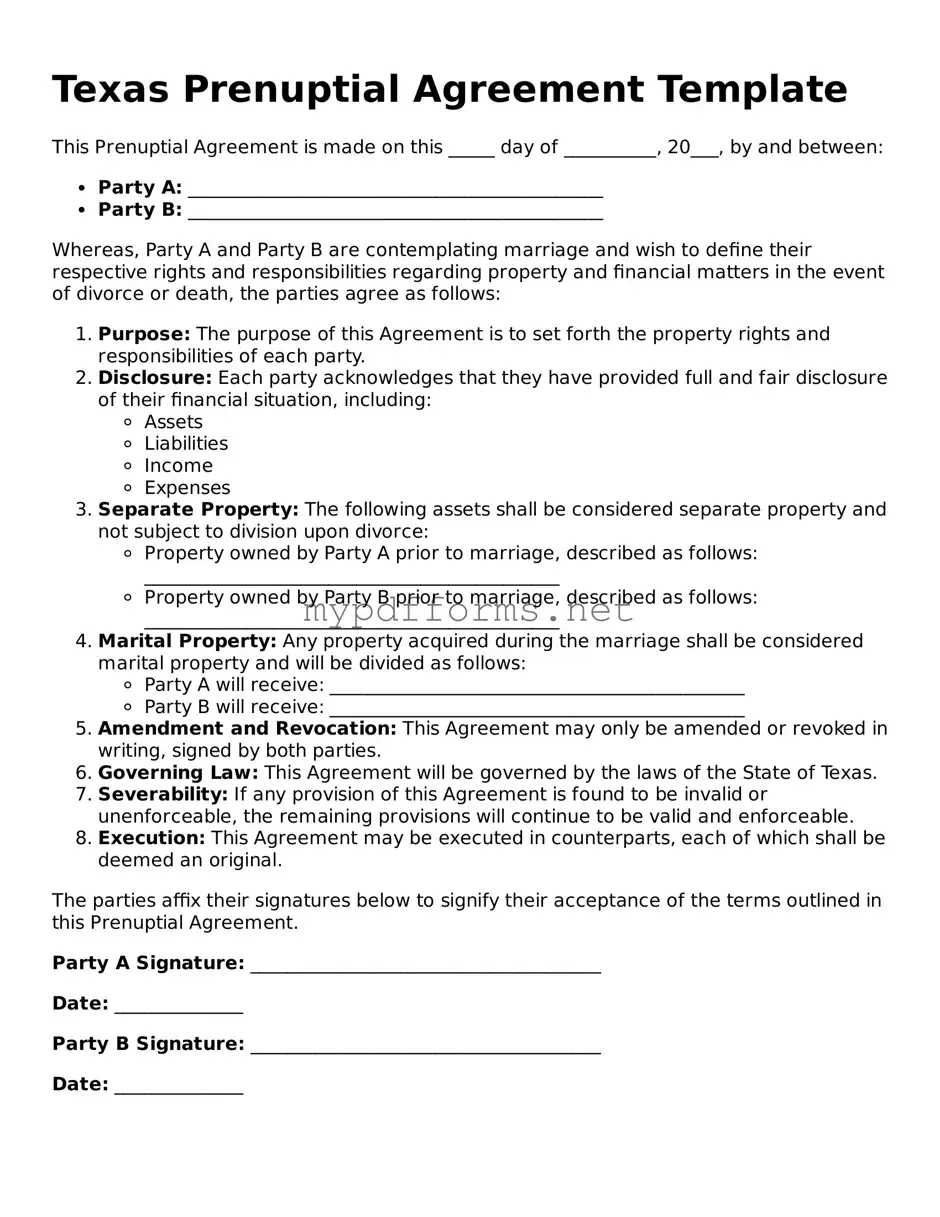

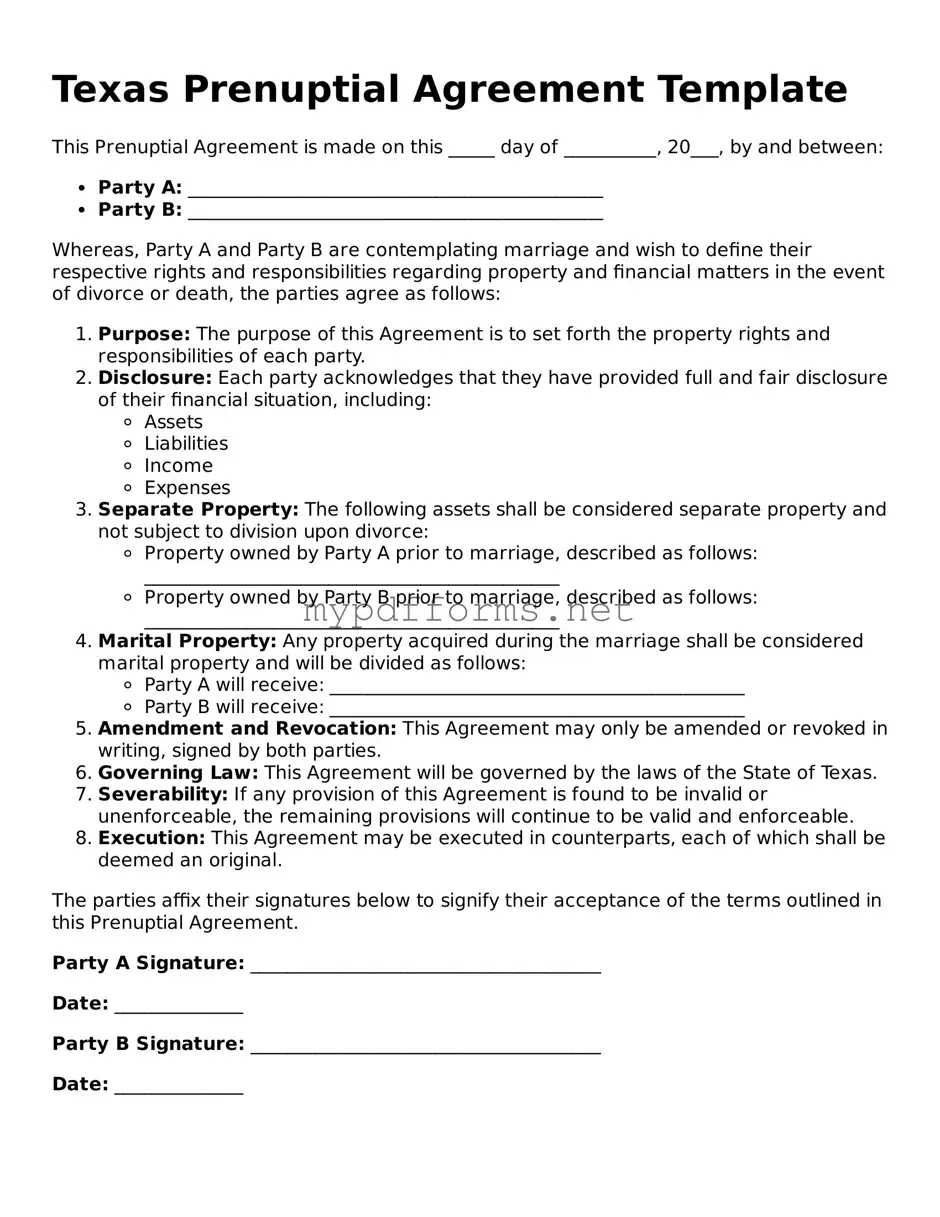

Attorney-Verified Prenuptial Agreement Document for Texas

A Prenuptial Agreement in Texas is a legal document that outlines the division of assets and responsibilities in the event of a divorce or separation. This agreement helps couples clarify their financial rights and obligations before entering into marriage. To ensure your interests are protected, consider filling out the Texas Prenuptial Agreement form by clicking the button below.

Modify Document Here

Attorney-Verified Prenuptial Agreement Document for Texas

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Prenuptial Agreement online in just a few steps.