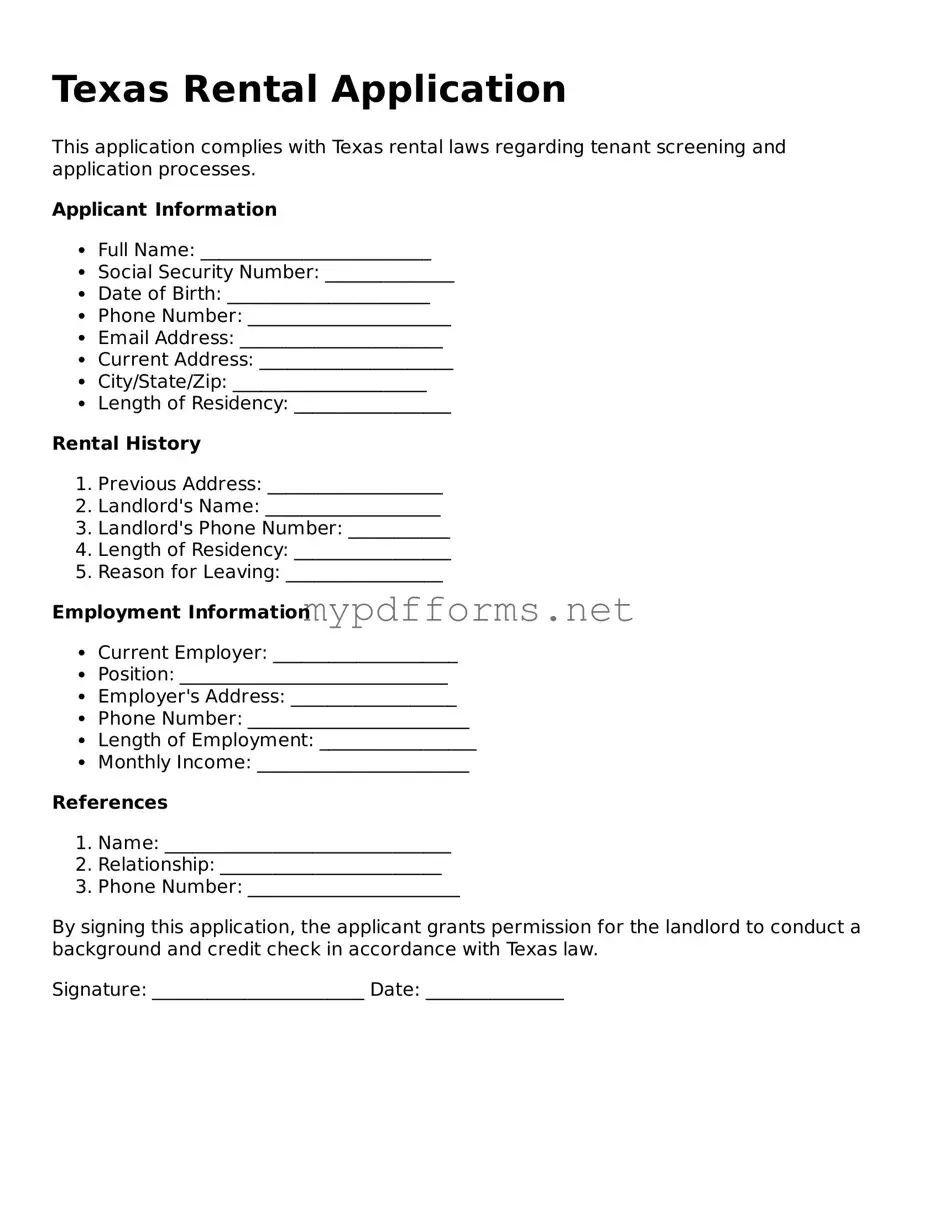

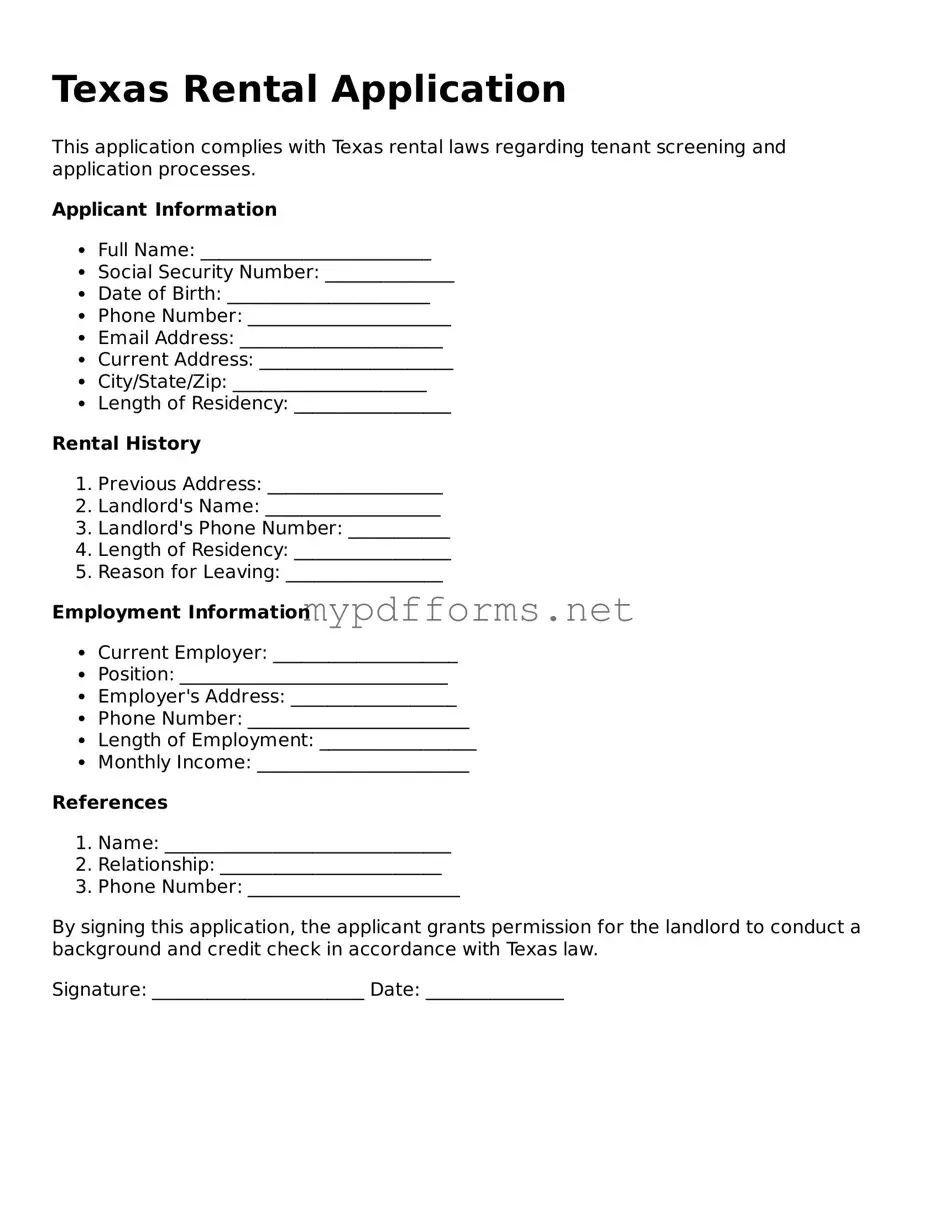

The Texas Rental Application form shares similarities with a standard Lease Agreement. Both documents are essential in the rental process, outlining the terms and conditions of the tenancy. While the Rental Application focuses on gathering information about potential tenants—such as their employment history, credit score, and rental history—the Lease Agreement formalizes the relationship between the landlord and tenant. It includes details like rent amount, duration of the lease, and responsibilities of each party. Essentially, the Rental Application serves as the first step towards the commitments laid out in the Lease Agreement.

Another document akin to the Texas Rental Application is the Tenant Screening Report. This report often accompanies the application and provides landlords with a comprehensive background check on prospective tenants. It typically includes credit history, criminal records, and past evictions. While the Rental Application collects information directly from the applicant, the Tenant Screening Report offers an external verification of that information, helping landlords make informed decisions about who to rent to.

The Rental Agreement is also similar to a Rental Application in that both are used to establish terms for renting a property. However, the Rental Agreement is more comprehensive and legally binding, detailing the rights and obligations of both parties. While the Rental Application is about assessing potential tenants, the Rental Agreement is the formal contract that outlines what happens once a tenant is approved. Both documents are crucial in ensuring clarity and understanding between landlords and tenants.

To better prepare for unforeseen circumstances, it's advisable to understand the benefits of having a Durable Power of Attorney documentation in place, as it enables trusted individuals to manage essential decisions on your behalf.

A Credit Application is another document that resembles the Texas Rental Application. Like the Rental Application, the Credit Application seeks to gather financial information about the applicant. This document typically includes details about income, debts, and credit history. While the Rental Application may focus more broadly on rental history and personal information, the Credit Application dives deeper into the financial aspects, helping landlords assess the applicant's ability to pay rent consistently.

Lastly, a Guarantor Application can also be compared to the Texas Rental Application. This document is used when a tenant needs someone to co-sign the lease, often due to insufficient credit history or income. Similar to the Rental Application, the Guarantor Application collects personal and financial information about the guarantor, allowing landlords to evaluate the co-signer’s ability to cover the rent if the tenant defaults. Both applications play a critical role in the rental process, ensuring that landlords have the necessary information to make sound decisions.