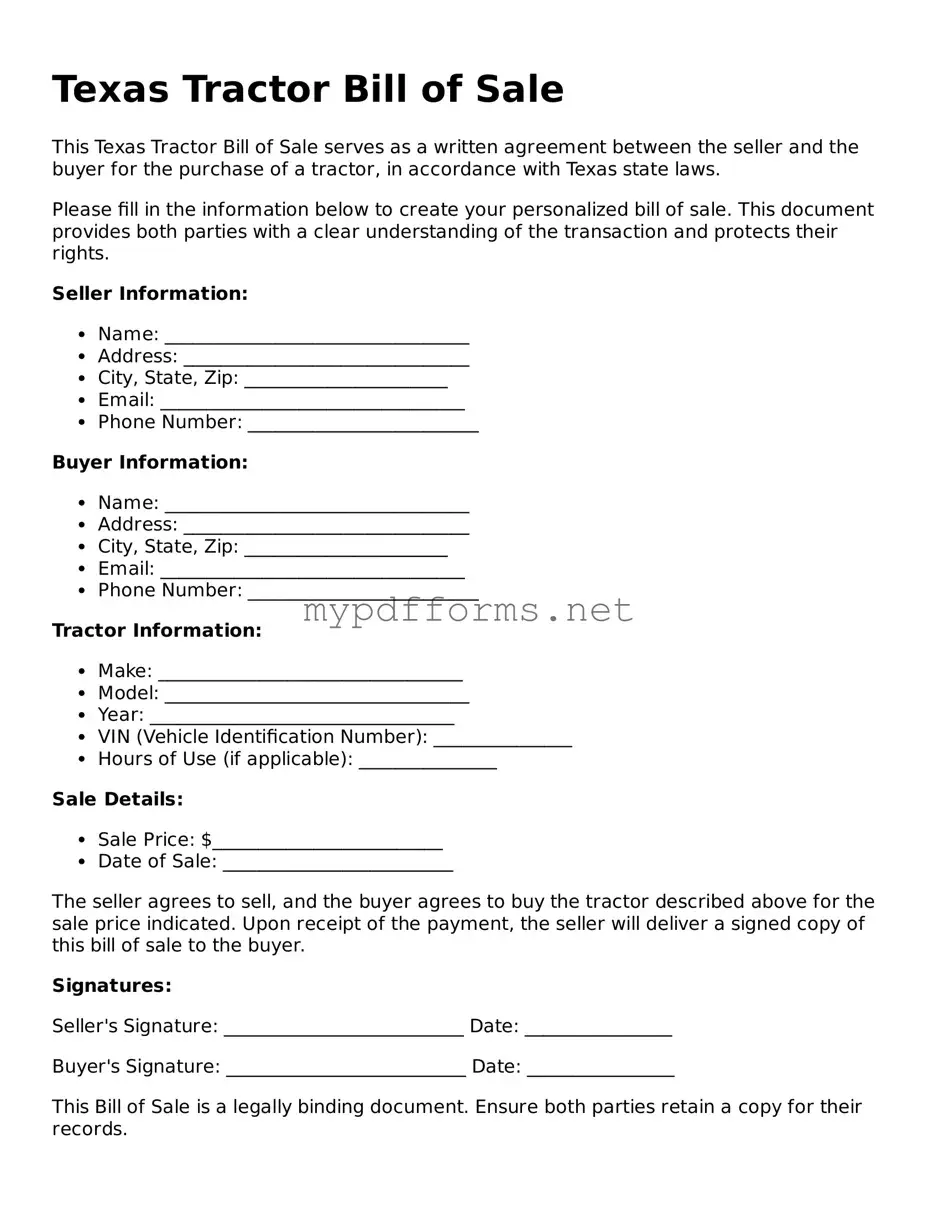

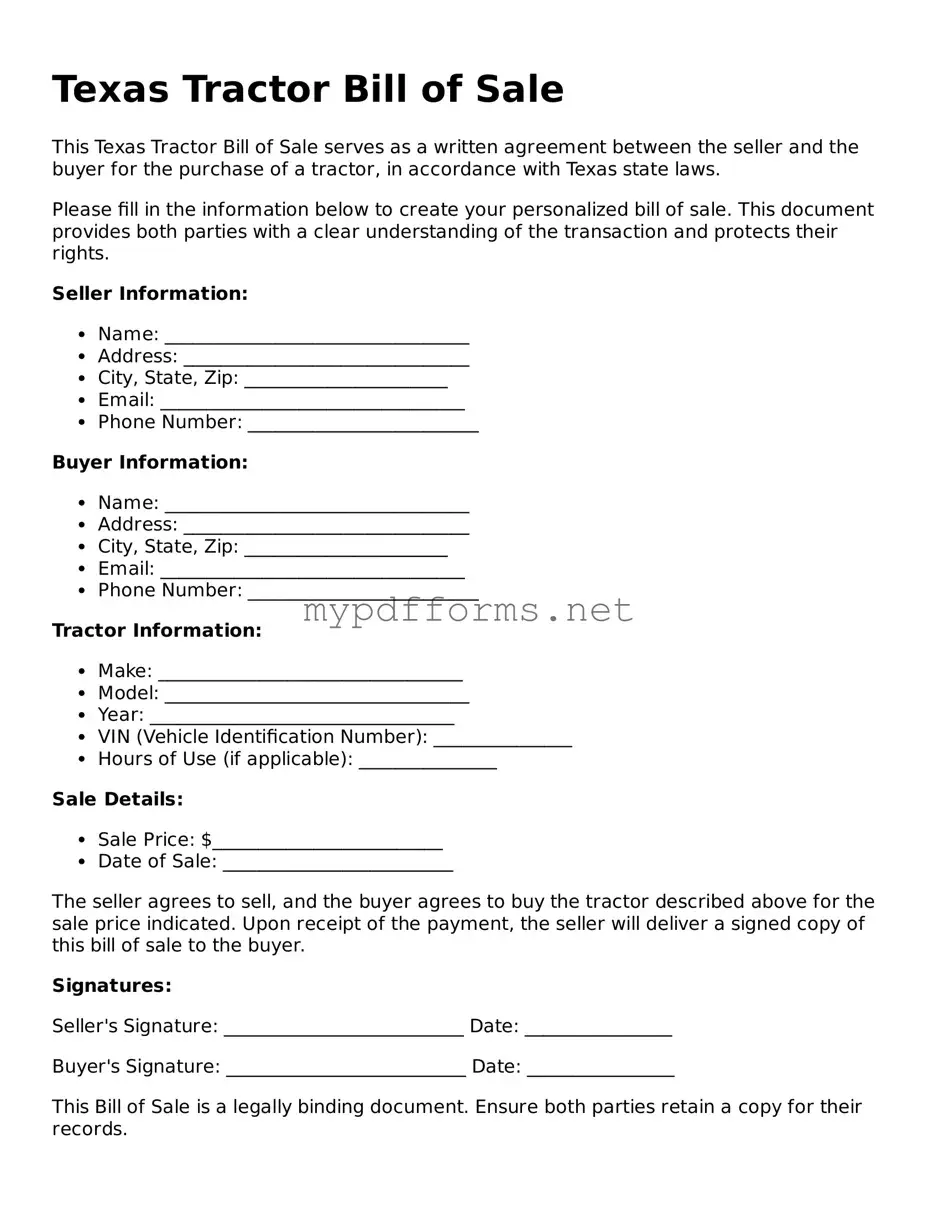

Attorney-Verified Tractor Bill of Sale Document for Texas

The Texas Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor in Texas. This form serves as proof of the transaction and includes essential details such as the buyer's and seller's information, tractor specifications, and sale price. To ensure a smooth transfer of ownership, it is important to complete this form accurately.

Ready to fill out the form? Click the button below to get started!

Modify Document Here

Attorney-Verified Tractor Bill of Sale Document for Texas

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Tractor Bill of Sale online in just a few steps.