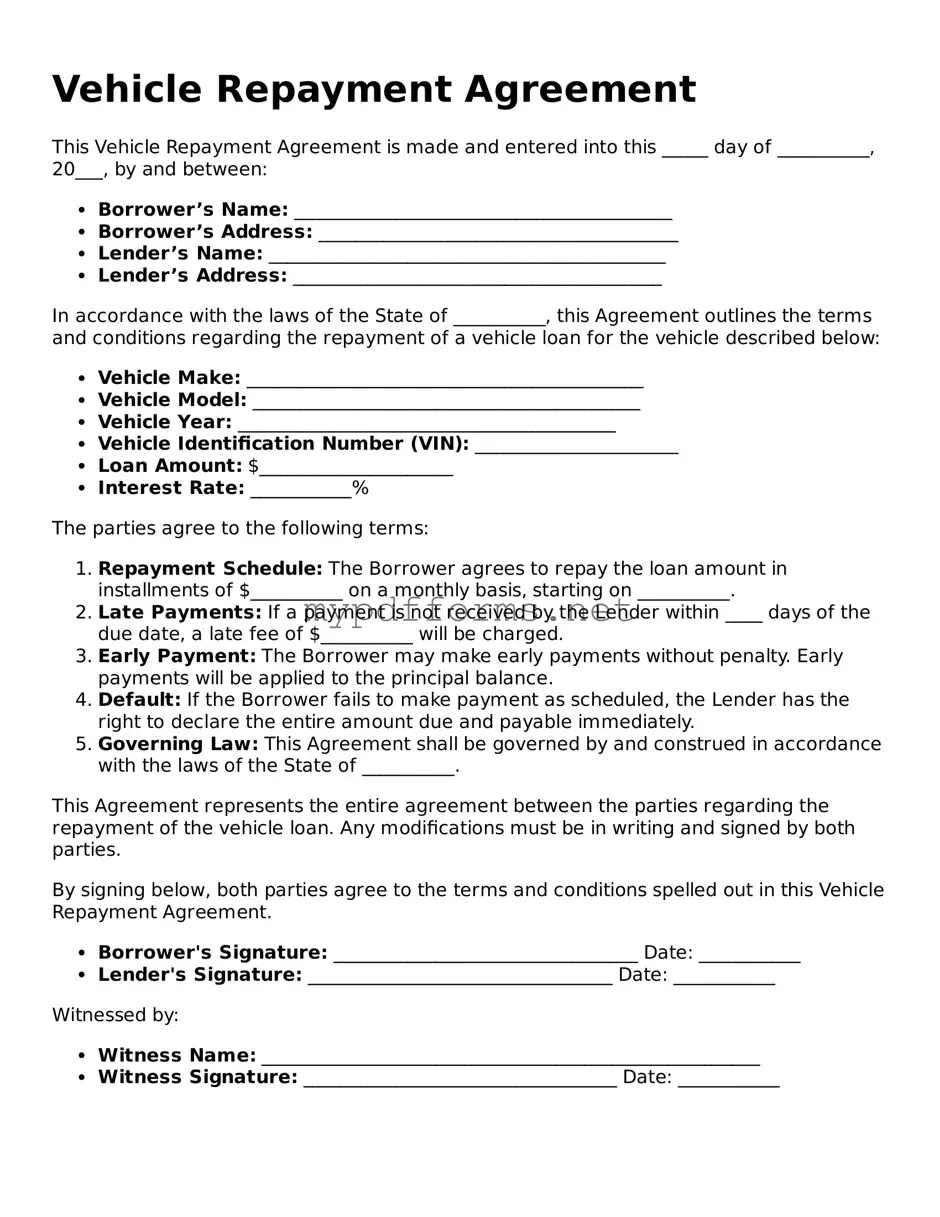

The Vehicle Purchase Agreement is similar to the Vehicle Repayment Agreement in that both documents outline the terms and conditions related to the purchase of a vehicle. This agreement typically includes details such as the purchase price, payment terms, and any warranties or guarantees provided by the seller. Both documents serve to protect the interests of the buyer and seller, ensuring that each party understands their rights and responsibilities in the transaction. The clarity provided by these agreements helps to prevent misunderstandings and disputes down the road.

In the context of vehicle transactions, understanding the nuances of various documents is crucial for both buyers and sellers, especially when it comes to ensuring a smooth transfer of ownership. For instance, utilizing a motorcyclebillofsale.com/free-new-york-motorcycle-bill-of-sale/ can provide necessary documentation to facilitate this process, highlighting essential details and protecting the rights of both parties involved.

The Loan Agreement shares similarities with the Vehicle Repayment Agreement, particularly in how it defines the terms of borrowing. A Loan Agreement specifies the amount borrowed, interest rates, repayment schedule, and consequences of default. Like the Vehicle Repayment Agreement, it serves as a binding contract between the lender and borrower, ensuring that both parties are aware of their obligations. This document is crucial for establishing trust and accountability in financial transactions.

The Lease Agreement is another document that resembles the Vehicle Repayment Agreement in its focus on the terms of use and payment for a vehicle. While a Vehicle Repayment Agreement pertains to ownership, a Lease Agreement outlines the terms under which a vehicle can be used without transferring ownership. It details the monthly payments, duration of the lease, and responsibilities for maintenance and insurance. Both agreements aim to clarify the financial commitments involved in vehicle use, ensuring that all parties are aligned on expectations.

The Bill of Sale is akin to the Vehicle Repayment Agreement as it serves as proof of the transaction between the buyer and seller. This document includes essential details such as the vehicle identification number (VIN), sale price, and signatures of both parties. While the Vehicle Repayment Agreement focuses on payment terms, the Bill of Sale confirms the transfer of ownership. Together, these documents provide a comprehensive view of the vehicle transaction, safeguarding the rights of both parties involved.

The Promissory Note is another relevant document that shares characteristics with the Vehicle Repayment Agreement. It is a written promise to pay a specified amount of money to a lender at a defined time or on demand. Like the Vehicle Repayment Agreement, it details the terms of repayment, including interest rates and due dates. Both documents emphasize the borrower's commitment to repay the borrowed funds, providing a clear framework for the financial relationship between the parties involved.